SMM May 31:

Copper prices fluctuated rangebound in May, hovering between 77,000-79,000 yuan/mt, while bare bright copper prices remained at 72,300-72,500 yuan/mt. In the first half of the month, copper prices fluctuated considerably, with an average daily % change of 700-1,000 yuan/mt. The price difference between copper cathode and copper scrap stayed at 1,300-1,700 yuan/mt. As secondary copper raw material suppliers still held bullish expectations for copper prices, they chose to withhold goods during price declines. Consequently, their inventory cycles lasted 2-3 days. During price increases, influenced by bullish sentiment, they were reluctant to sell excessively, leading to overall tight supply in the secondary copper raw material market in the first half of May, resulting in a trend where prices followed gains but not declines.

In the second half of the month, the fluctuation range of copper prices narrowed, with daily changes of 400-600 yuan/mt. As copper prices continued to fluctuate rangebound, many secondary copper raw material suppliers grew concerned about a potential sudden drop after prolonged consolidation. They were willing to sell newly acquired materials as long as marginal profits were achievable, adopting a quick-in, quick-out strategy. This boosted procurement volume for many secondary copper rod enterprises. However, prices such as bare bright copper deviated from reasonable levels by 200-300 yuan/mt, and secondary copper rod enterprises averaged losses of 300-400 yuan/mt in gross profits during May. Additionally, as May is traditionally an off-season for domestic end-use consumption, high raw material costs and mediocre downstream demand left many secondary copper rod enterprises in losses throughout the month. Some reported that high-grade secondary copper raw material prices were unreasonable, and insufficient supply made it difficult to sustain continuous production. Thus, some enterprises manually sorted purchased secondary copper raw materials, using high-grade scrap for secondary copper rod production and low-grade scrap for copper anode, ensuring smelting furnaces remained operational.

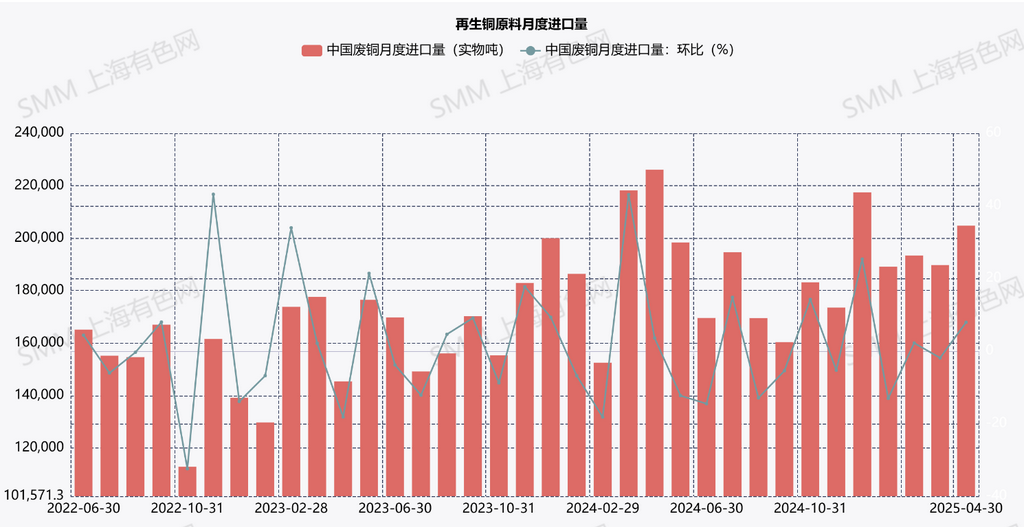

On imports, secondary copper raw material imports in April totaled 204,700 mt, up 7.9% MoM. Based on shipping schedules, these materials were ordered by traders in February and March, coinciding with post-Chinese New Year resumptions and the onset of the US-China trade war. Traders' motives for stockpiling and preemptive purchases to avoid tariff impacts drove the slight increase in April imports. However, May imports are expected to decline significantly, as the US-China trade war was in full swing during March and April, with high tariffs deterring many traders from US purchases. Without US supply, China's secondary copper raw material imports may face tightness.

Looking ahead to May, as regions across the country intensify efforts to implement "reverse invoicing," the increase in procurement costs of secondary copper raw materials may force secondary copper rod enterprises to lower the prices of secondary copper raw materials. The price difference between copper cathode and copper scrap is expected to widen. Additionally, imported secondary copper raw materials, which include VAT invoices, have a natural advantage over foreign secondary copper raw materials. It is expected that more and more secondary copper rod enterprises will purchase imported secondary copper raw materials, and prices will rise accordingly.